modified business tax nevada instructions

A Nevada Employer is defined as per NRS 363B030. Line-through the original figures in black ink.

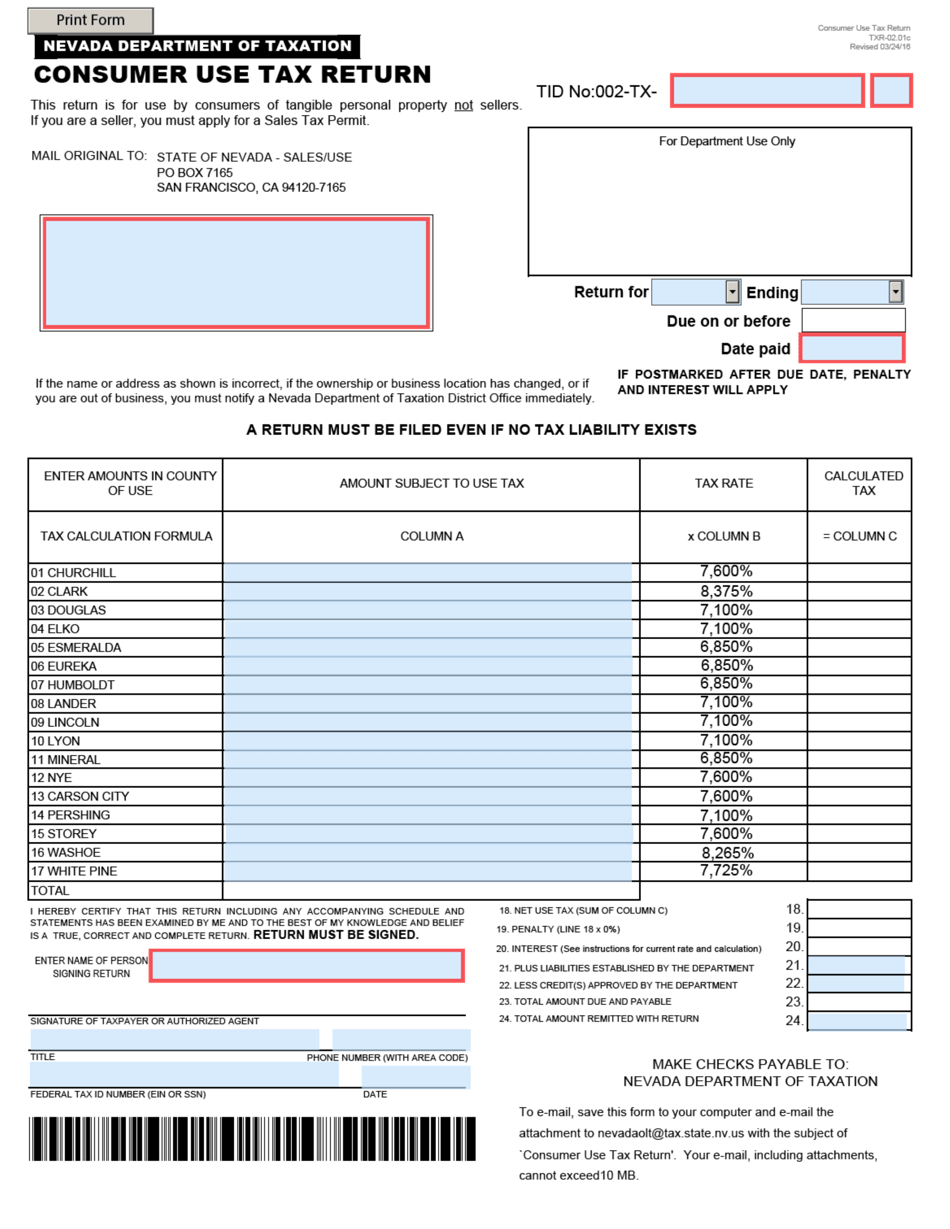

Nevada Consumer Use Tax Fill Out And Sign Printable Pdf Template Signnow

Complete the necessary fields.

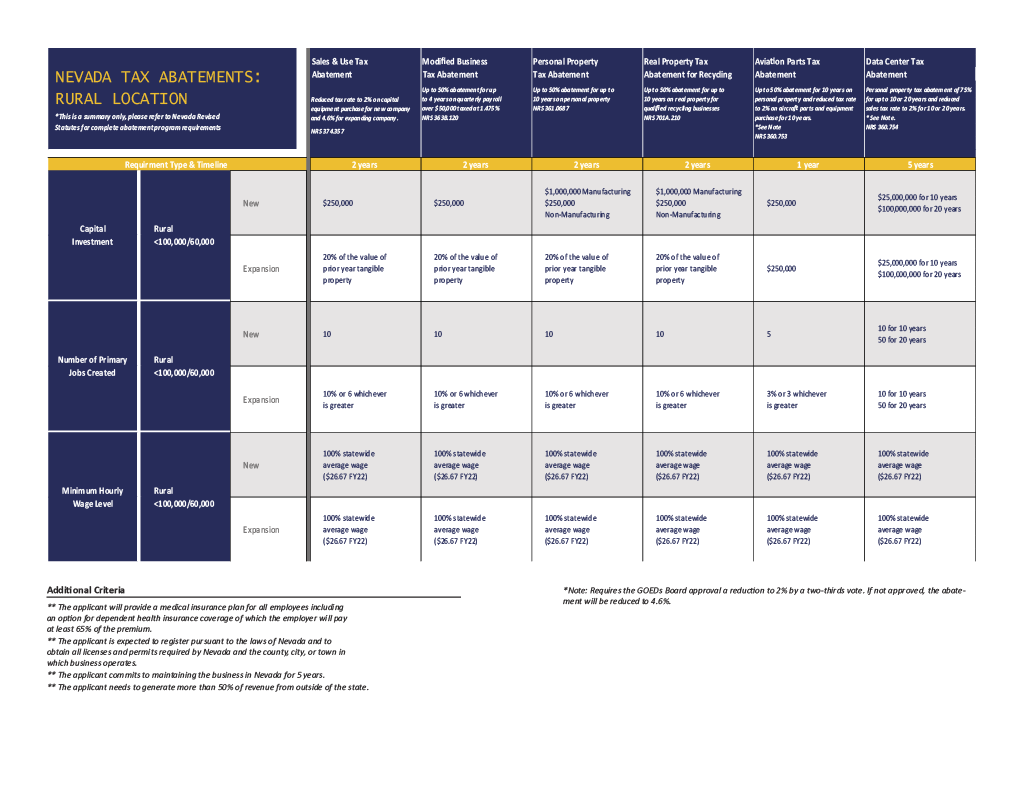

. A partial abatement of the business tax during the initial period of operation is available. Every employer who is subject to Nevada Unemployment Compensation Law NRS 612 is also subject to the Modified Business Tax on. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying.

Include a copy of the original return 2. Modified Business Tax. Open the document in the full-fledged online editor by hitting Get form.

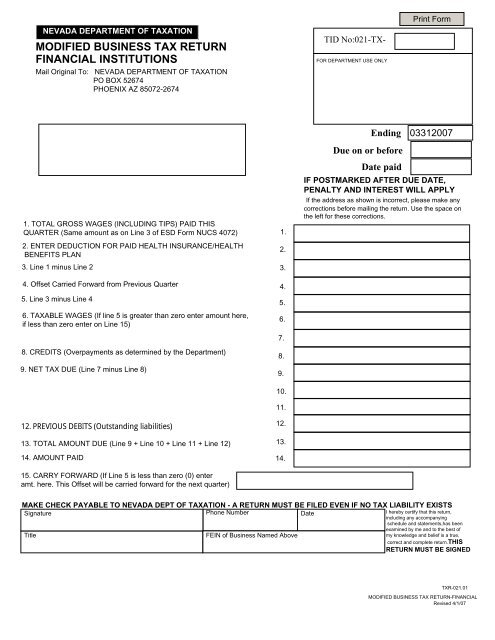

Put simply most businesses must pay this tax and the process is often convoluted. Total gross wages are the total amount of all gross wages and reported tips paid. Senate Bill 429 from the 2009 Session changed the structure and tax rate for the MBT-NFI by creating a two-tiered tax rate in lieu of the single rate of 063 effective July 1 2009.

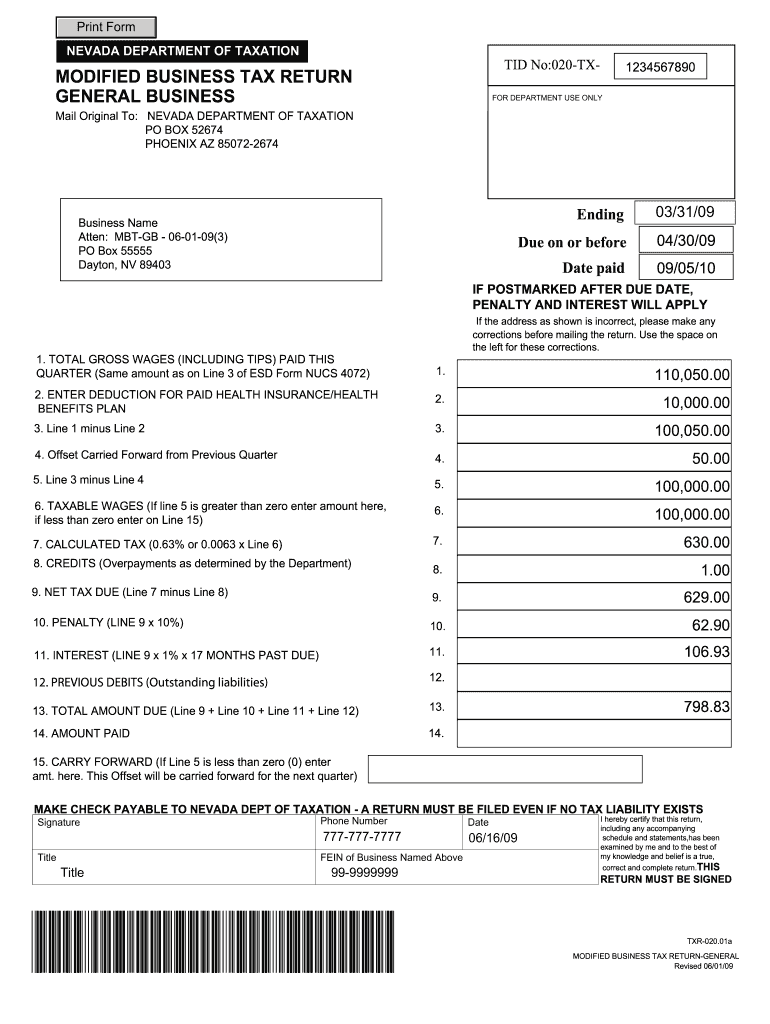

MODIFIED BUSINESS TAX RETURN 1. Write the word AMENDED in black ink in the upper right-hand corner of the return. The tips below can help you fill out Nevada Modified Business Tax quickly and easily.

The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter. The rates by industry sector are set. Email the amended return along with any additional documentation to email protected OR mail your amended.

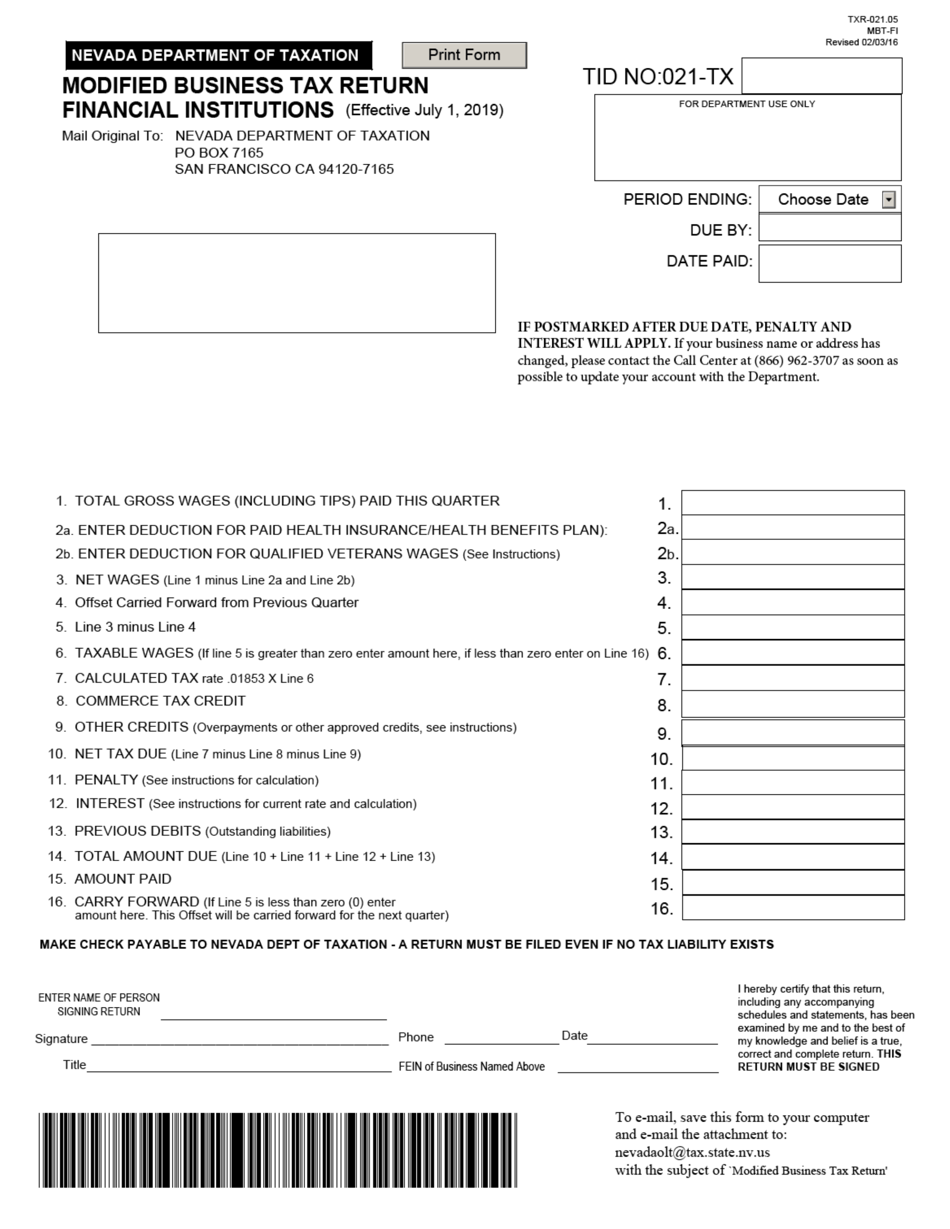

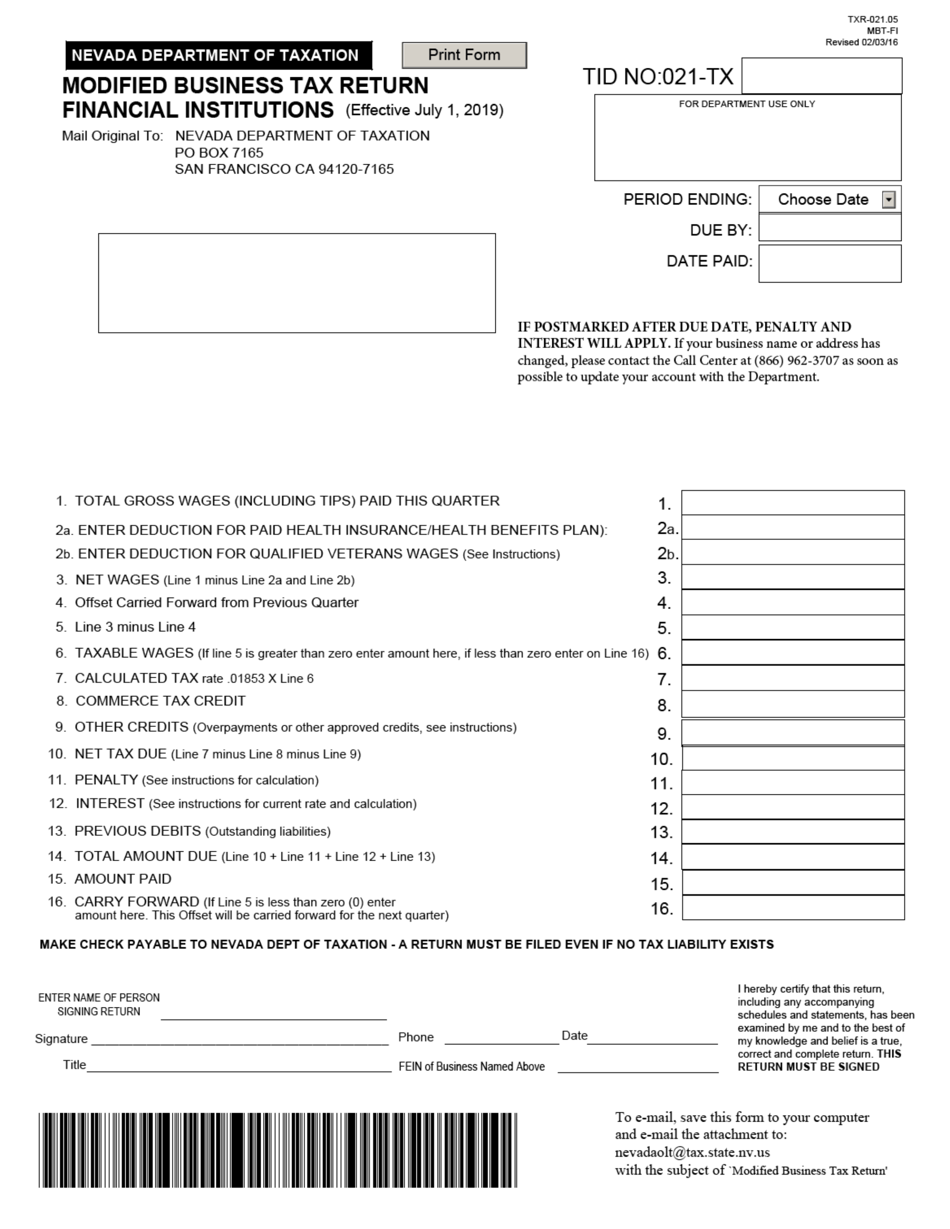

Right click on the form icon then select SAVE TARGET. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. Select the document you want to sign and click Upload.

Ad pdfFiller allows users to edit sign fill and share all type of documents online. As in most states ever employer subject t the states unemployment compensation law is subject to a Modified. PdfFiller allows users to edit sign fill and share all type of documents online.

Overview of Modified Business Tax. Any employer who is required to pay a contribution to the Department of. Similar to the personal income tax businesses must.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. Modified Business Tax NRS 463370 Gaming License. The tax rate varies depending on the type or classification of earned business revenue.

Follow the step-by-step instructions below to design your modified business tax return nevada. How do I change my modified business tax return in Nevada. When the Nevada Revenue Plan was adopted back on May 31 2015 by the Nevada Legislature it altered the landscape of business taxes within the state.

The Commerce Tax is a tax on Nevada-sitused gross receipts. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser. Understanding the Nevada Modified Business Return and Tax Form.

The documents found below are available in at least one of three different. Get nevada modified business tax 2008 form signed right from your smartphone using these six tips. The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and.

The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. The Nevada corporate income tax is the business equivalent of the Nevada personal income tax and is based on a bracketed tax system. Signature Date 1 to 10 11 to 15.

If you dont have an. NEVADA DEPARTMENT OF TAXATION Title Phone Number Mail Original To. Indeed the Nevada Modified Business Tax formthe Nevada TXR-020 and additional TXR-021is difficult.

Businesses that have ceased doing business gone out of business in Nevada must notify Employment Security Division and the Department of Taxation in writing of the date the. Nevada Modified Business Tax Rate.

Business Friendly Nevada Northern Nevada Development Authority

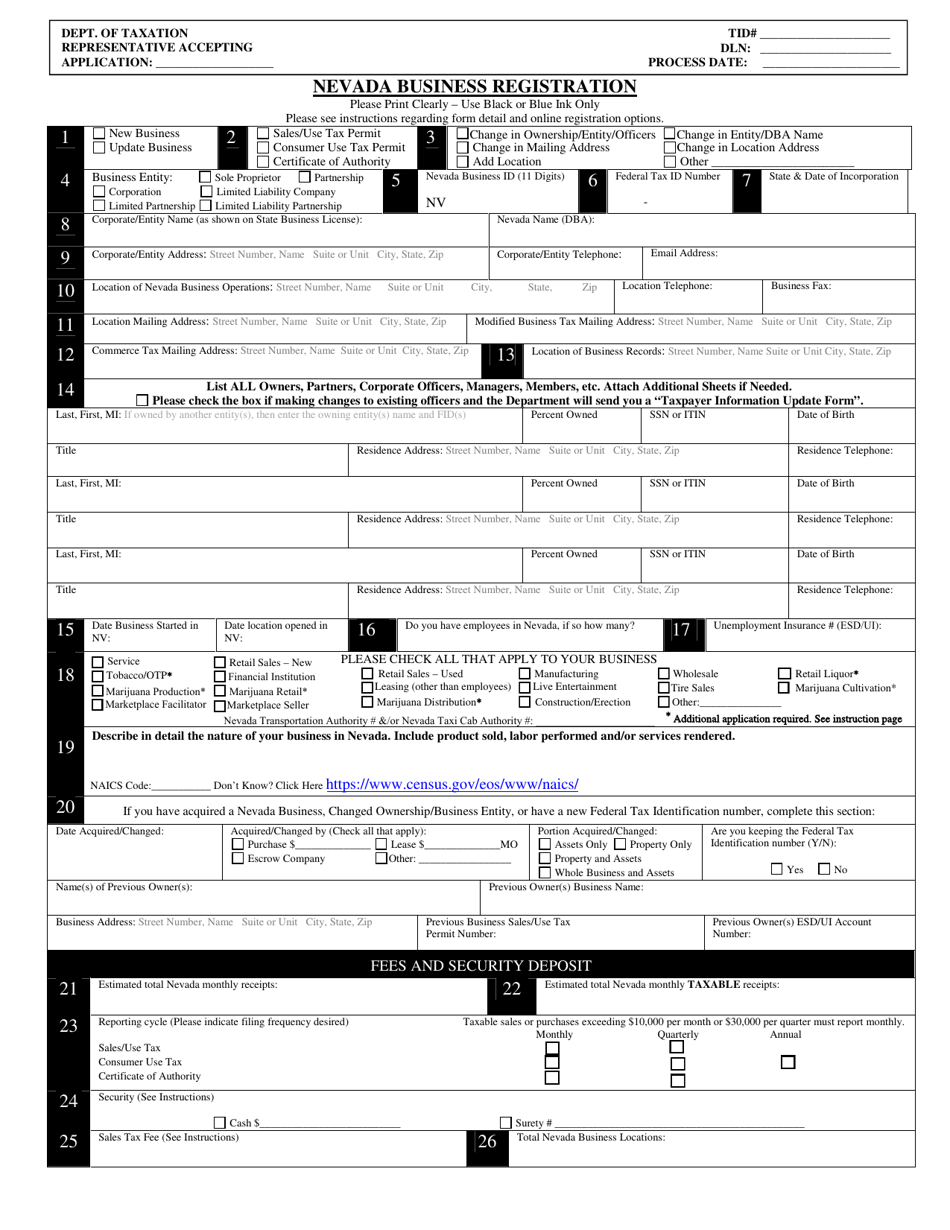

Nevada Nevada Business Registration Form Download Fillable Pdf Templateroller

Incorporate In Nevada Do Business The Right Way

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

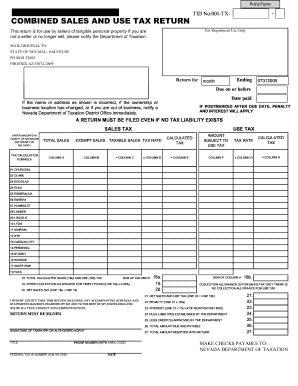

How To File And Pay Sales Tax In Nevada Taxvalet

Does Qb Offer The Nv Modified Business Tax Payroll Form

How To File And Pay Sales Tax In Nevada Taxvalet

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller

Modified Business Tax Return Financial Institutions

Form Txr 02 01c Download Fillable Pdf Or Fill Online Consumer Use Tax Return 2021 Nevada Templateroller